Automation of financial accounting in Dynamics 365 Finance: New functions of the Bank Automation Suite

Share:

What is the Bank Automation Suite?

The Bank Automation Suite is an add-on developed by us for Microsoft Dynamics 365 Finance that automates financial accounting processes. Using recognition rules that companies can define themselves, it automatically compares account statements and payment advice notes with open items. With a hit rate of over 95%, the Bank Automation Suite significantly reduces manual effort and minimises errors. It supports a wide range of common file formats and can be implemented quickly and without major project effort.

Manual accounting tasks are time-consuming and error-prone. What's more, the requirements and specifications in this area are also constantly changing. With the latest version of the Bank Automation Suite, our add-on for Microsoft Dynamics 365 Finance, we are taking these changing requirements into account and ensuring that you can automate central processes in your financial accounting even better in future. This blog post gives you an overview of the latest functions and changes in the Bank Automation Suite.

New functions of the Bank Automation Suite for Dynamics 365 Finance

1. Assign payment advice notes subsequently

This is how it should actually work in accounting: First the company receives the payment advice note, then the payment is made. In practice, however, it often looks different. Payments are received first and the payment advice note is submitted later. With the latest version of the Bank Automation Suite, this case is now also automated:

Based on the information in the payment advice note, the open items are subsequently assigned to the incoming payment and cleared. This will save you even more time in future and reduce the risk of errors caused by manual intervention. In the standard version of Dynamics 365 Finance, this still has to be done manually.

We've all seen it before: Payment references often contain unnecessary data such as number combinations or cryptic characters. It is then time-consuming for accounting staff to identify the important information and read it correctly. With the new version of the Bank Automation Suite, this is now much easier in Dynamics 365 Finance. This is because bank-specific parameters can now be defined that are really relevant for incoming bookings. And only these are then imported into Microsoft ERP and used for the automatic reconciliation of open items. Incoming payments can therefore be posted even faster and more accurately.

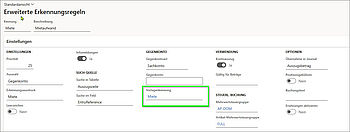

3. Automate split postings

In practice, it is often the case that an incoming payment has to be distributed to several accounts or cost centres. This is why the new version of the Bank Automation Suite now offers a function that allows you to define recognition rules for split postings. Using these rules, the system then automatically recognises how a payment should be split and the posting records are created accordingly. The distribution to several cost centres is therefore automated, takes less time and is less prone to errors.

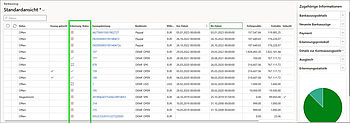

4. More overview on the statement header

The overview page, on which all transactions are listed, has also been revised. Icons now show you at a glance whether defined recognition rules have been completed and transactions can be finalised directly or whether a manual adjustment is required. This allows accounting staff to process transactions more quickly and gives them a clear overview of any further steps required.

5. Automate foreign transactions

Thanks to extended functions in the Bank Automation Suite, foreign transactions can now also be automated more efficiently. New is the support of camt.054 files, which are especially relevant for invoices from Switzerland. In addition, labels for Switzerland (DE-CH) and Romania have been integrated to better cover country-specific requirements. Adjustments have been made to the MT940 format to simplify transactions from Australia and South Africa - the previously mandatory 86 record is no longer required here. In addition, mandatory fields for reconciliation with Chinese journals have been added to enable smooth transactions in the Asian region. From now on, these enhancements will also enable more automation in international payment transactions.

If you are already using the Bank Automation Suite

The latest functions of the Bank Automation Suite have been available since December 2024. Customers who already use the add-on have already received the update. If you need support in using the new functions, our experts will be happy to assist you.