Automation within Financial Accounting

Share:

- Importing the account statements of the individual banks into the ERP

- Correctly posting the account movements (incoming and outgoing payments)

- Checking/reconciling the bank balances every day for accuracy

These are the three central recurring tasks that employees in every company’s financial accounting department deal with daily. In large companies with a high number of invoices, these employees hardly get to do anything else.

According to our research, much of this process is still done manually; even in the age of digitalization.

A look into the standard of ERP systems

The answer may come as a surprise: The standard version of many ERP systems, including Microsoft's flagship ERP system Microsoft Dynamics 365 Finance, can automate many, so many processes—but not all of them. And entering posting records and balancing accounts is not one of them.

For Microsoft, this was already the case with AX in 2009 and has not changed with the latest feature update a few months ago for Dynamics 365 Finance. If you don't actively expand your Dynamics 365 ERP at this point, you can still automate a lot in the area of financial accounting—just not everything.

A brilliant idea 15 years ago

About 15 years ago, Inway Systems GmbH pondered that it must be possible to do this automatically. Back in 2009, Senior Developer Peter Braun developed a solution for a customer that automated certain processes within Dynamics AX, without changing the posting logic, especially when reconciling posting records against open items. This was the birth of the Bank Automation Suite, an add-on for Microsoft Dynamics AX (later for Finance & Operations and today for Finance & Supply Chain Management).

We have written a lot about the Bank Automation Suite since then. There are numerous informative blog posts, factsheets and brochures, videos and webinars.

What we don't have yet, however, is a comparison of the core functions regarding the ERP system: What can the Bank Automation Suite do that the huge ERP system Dynamics 365 Finance from Microsoft can’t without the add-on?

1.1 Is the import of account statements a manual activity?

No. Since AX 2012, the Microsoft standard has been able to import the common electronic report formats, i.e. MT940 and CAMT.053 (daily statement) or CAMT.054 (interim statement during the day), from the banks into the ERP without any problems. Initially, you had to set up several mappings in advance and the linking within AX 2012 was somewhat complicated. Today, you can set up this import effortlessly in the standard system.

Even if we would like to mention at this point that our add-on has been able to import bank statements since 2009, three years before Microsoft, today this is no longer the central added value the Bank Automation Suite offers you. What remains are a few convenient functions that it can do, whereas the Microsoft standard cannot.

1.2 Replacement tables and cut-out tables

Electronic account statements transport significantly more information than the standard account statement. At Microsoft, all this data, including metadata, is imported in the same way as the bank delivers it in the MT940 and CAMT.053 formats. In this regard, the Bank Automation Suite has two functions that Dynamics 365 does not offer as a standard: the intelligent replacement and cut-out tables based on regular expressions.

The information and metadata of the electronic reports can be “prettied up” here. In other words, you can cut out or remove information that is not relevant before the import. At the same time, the Bank Automation Suite is able to translate certain codes and cryptic identification numbers (transaction codes, company codes, tax codes, etc.) into “plain text”. Instead of a 12-digit number, you would then read "Marketing cost center" or whatever else you prefer.

1.3 Multiple sources for importing data

To import account statements into the ERP, your data must first be in Microsoft SharePoint. Only then you can import it with Dynamics 365.

If you use the Bank Automation Suite, however, you are somewhat more flexible and have other sources available in addition to SharePoint, such as Azure Directory, FTP or even local folders. Customers who are not currently in the cloud can therefore only automate this first step if they use the Bank Automation Suite. With no cloud, there is no upload from SharePoint. The only other solution: You must manually upload the account statements to the system every day and for every bank. With our Bank Automation Suite, all you need to do is save them in a local folder.

1.4 Conclusion on the import of account statements

When it comes to importing account statements, the Bank Automation Suite is slightly ahead, but it does not offer much added value. The tool mainly shows its strengths and superiority in the next point, namely when it comes to posting all account movements (incoming and outgoing payments).

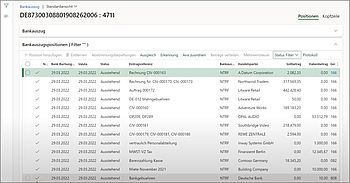

2.2 How booking works in the standard version of D365; without the Bank Automation Suite

Once your electronic account statement has been read in, it is now time to process this statement line by line. Ideally, the employee uses two monitors for this, or has a massive screen.

One monitor shows an open posting journal, usually the “general entry”, as all transactions can be posted here. Alternatively, he or she uses the optimised entries for the individual transactions:

- Customer payment entry for cash receipts

- Vendor payment entry for outgoing payments

- General entry for various things, including account or conversion fees

On the other monitor, he or she has opened the imported bank statement.

They then record the incoming or outgoing money in the corresponding journal for each statement line. This is followed each time by a long, monotonous series of clicks and entries (you’re welcome to ask the employees who do this daily), for example:

- Entering customer or vendor (or select from a list)

- Entering the payment details (including amount, date, purpose, customer number)

- Opening a list of all outstanding account transactions of the customer or vendor via open items

- Assigning the amount from the account statement to the corresponding counterpart in this list

- Final check

The first line is now complete. The next 100 lines will follow.

Experienced employees achieve an average of 90 seconds per booking. But even with this performance, estimating 100 account transactions per day, this colleague still spends 2.5 hours with nothing else. And 100 account transactions per day are not exactly a lot …

2.3 How booking works in the D365 standard with our Bank Automation Suite

As soon as the Bank Automation Suite has automatically imported the account statements into the ERP, it gets to work again and carries out steps 1 to 4 by itself.

When the financial accounting employee opens their ERP in the morning, all account transactions have already been assigned and the entry lines are filled thanks to the Bank Automation Suite. All they needed to do is a quick check and the final posting. Admittedly, there are days when the Suite doesn’t assign all account transactions correctly. In this case, your employee needs to do some “reworking”. However, the Bank Automation Suite achieves recognition rates of up to 95% when set up correctly. This means that 95 out of 100 posting lines are fully automated—leaving 5 that need to be posted manually.

2.4 What is the Bank Automation Suite’s secret?

A good magician never reveals their tricks, and a good developer never reveals their code. Consequently, scarcely any people know the exact reason why the Bank Automation Suite is one of very few tools on the market that is able to post account transactions automatically.

We only want to reveal this much: It works via recognition rules. The add-on transfers a set of rules to Dynamics ERP, which companies can then set up flexibly. Of course, we help with this as part of the initial setup. The relevant fields are then automatically checked during data import (see point 1). The purpose is often sufficient, as that’s where you find the most important information (customer and invoice number). The suite then compares this data with the corresponding open invoices in the system and clears them.

Naturally, the result of the Bank Automation Suite is always just a booking proposal. Accountants still have full control over the actual posting. However, they then only need to check and, if necessary, process account movements that were not recorded using the rules. At this point, however, the time savings are already enormous.

2.5 Conclusion on the correct posting of account transactions

If you look at the posting of income and expenses, it becomes clear where the advantages of the Bank Automation Suite lie compared to the Dynamics 365 standard. Let’s stay with the example of 100 daily account transactions: Instead of 2.5 hours, this will become a task of no more than 30 minutes. This means you could save 40 hours each month. Why has Microsoft struggled to offer this function since 2009? We don't know, but we are pleased to have a solution with our add-on that has reliably closed this gap for 15 years.

3. Checking the Bank Balances Daily for Accuracy

It’s cut a long story short: Dynamics 365 ERP and the Bank Automation Suite can do this in equally well. This information is available to you immediately after importing the account statements into the ERP. If you have started reading at this point, be sure to have a look at the second point above.

Bank Automation Suite Vs. D365 ERP: Our Summary

Remember, the Bank Automation Suite is only an add-on to a large, existing and very comprehensive ERP system, not a stand-alone solution. The question whether to use our tool or an ERP system therefore does not arise. Nevertheless, this add-on has been reliably closing a gap for over 15 years that Microsoft has still not closed for Dynamics 365. This means that anyone who uses the ERP system for financial accounting should seriously consider using this add-on.

Is it worth it?

With very few account transactions per day (1 to 10), the time saved is probably quite manageable. However, due to the process security (no manual errors, transposed figures), it can also be worthwhile here.

It is definitely worth it if you save one hour a day or more. And this is usually the case with 40 to 50 account transactions per day. However, companies typically have significantly more.

You can calculate for yourself when and how exactly this investment will pay off financially and after how many weeks/months you will reach the ROI (return on investment). Do this either by hand or—you know us by now: we like to automate—with the help of our ROI calculator. This is a small Excel tool that quickly calculates when you will start to benefit financially from the Bank Automation Suite. Download this free tool here:

ROI-CALCULATOR: WHEN DOES THE BANK AUTOMATION SUITE START TO PAY OFF?

We are also happy to help you in a short session via Teams etc. discussing your requirements and your initial situation. You can find further information such as

- Blog posts

- factsheets

- brochures

- videos

- webinars

neatly arranged on our Bank Automation Suite overview page, as we mentioned at the beginning. You are welcome to read up and collect more information without any obligation.

![[Translate to English:] So funktioniert das Buchen im Standard von Dynamics 365 – ohne Bank Automation Suite](/fileadmin/_processed_/9/b/csm_Langes-manuelles-Buchen_15b6bf9e1d.jpg)